|

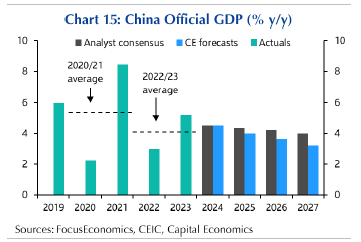

Asian markets from an investor’s view point have been rather underwhelming these last few years, with sentiment towards China (being 43% of the MSCI Emerging Markets Index) remaining disappointing despite relatively positive industrial production and retail sales data. The ongoing weakness in their outsized property market, a soft consumption-led recovery and geopolitics in Taiwan and the US have all weighed on sentiment. Chinese policy makers and their central bank have often cited their willingness to stabilise the economy and promote their economic strength however their measures to achieve sustainable growth has not eventuated to a level or pathway required at this point in time. China remains overly dependent on credit, foreign demand and exports rather supporting domestic consumption growth drivers. Repeated efforts in the short term to prop up the economy and in particular their construction industry has missed the longer term needs for rebalancing towards a more sustainable domestic economy, causing state debt and state spending to increase. While the property sector has reduced investment, the state has instead diverted capital towards other infrastructure projects and social housing (also via the use of credit) while population growth declines and the number of rural migrants moving to urban areas slows to a standstill. Poor return on investment by the state has interfered with economic progress resulting in disproportionate outcomes and resource allocation. A recent example, was the recent liquidity support issued by the PBOC to their banking system that seems designed to support higher borrowing costs and credit repayment conditions, rather than stimulating household demand or creating capital investment for their manufacturing sector. Official Chinese GDP has been edging down since 2019 and estimates appear this will continue in a downward trajectory: |

|

|

For what it’s worth amidst the noise, Australian shares should be in the higher single digits in 2024 not the bullish forecasts pushed by media commentators. This is due to some pockets of inflation remaining persistent in non-discretionary goods and services (water and electricity, insurance, rentals for example), and poor household sentiment. When it eventually occurs, reductions in cash and interest rates will be led from offshore, the US Federal Reserve then broadening into capital markets.

|

.png?upscale=true&upscale=true&%20Managing%20Debt%20(600%20x%20300%20px).png&width=558&height=250&name=Superannuation%20Strategies%20Retirement%20Planning%20Investment%20Strategy%20and%20Advice%20Financial%20Structures%20Quantitative%20Analysis%20Suitability%20%26%20Managing%20Debt%20(600%20x%20300%20px).png?upscale=true&upscale=true&%20Managing%20Debt%20(600%20x%20300%20px).png)