It is quite clear central banks are more concerned about their goals of inflationary control than the folding of some smaller US banks, Credit Suisse (now known for poor quality management) than your personal goals.

Whilst the US Federal Reserve has tools at hand, and issuing a deposit guarantee for the purposes of stability, they will maintain a hawkish approach of lifting rates further. The US Fed does have an inflationary and spending problem, however in Australia, the RBA is better placed where employment and private demand factors are softening already.

Historically, during periods of rising or high inflation, these have not been good for risk asset markets. But cycles change and economic growth is usually always achieved over the long-term. Sometimes excesses have to be withdrawn from the system. Recessions are in fact better for risk asset prices as long as they are relatively short in duration, and can often be a turning point, where low inflation and growth are preferred.

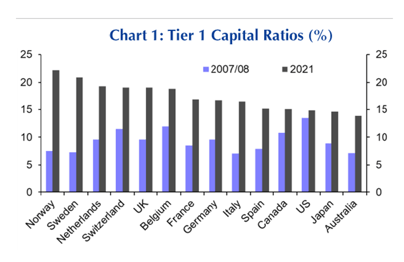

Balance sheet risk has not really been tested - not since the 2007/08 GFC - and property is yet to run its course. But ASX corporates and banks in particular are better capitalised since then (see Chart 1: Tier 1 Capital Ratios). Although some borrowers of the 2020-2022 vintage will feel the pain shortly, if they have not already. Credit advice should also be tailored to your individual needs, not just the sale of a loan. Such as how much should one borrow or what is an ideal loan-to-service ratio?

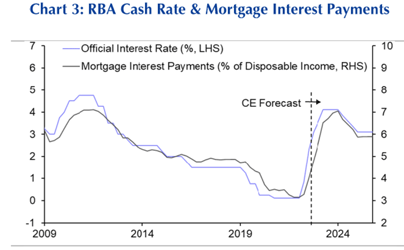

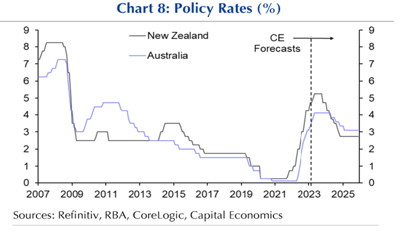

Annual variable rates of 7% are expected (please refer to Chart 3: RBA Cash Rate & Mortgage Interest Payments), perhaps even 7.20% where it will probably remain for a while. Credit supply is contracting and is likely to become difficult to access. While there is a positive correlation between credit supply and property values, there is also stronger positive correlation between economic growth and property prices. If economic conditions worsen in the short-term, so too will property prices. In the longer term, GDP forecasts for Australia are favourable - rising from 1.3% in 2024 to 3.5% in 2025 (Capital Economic Report, 22 March 2023).

Popular term deposits are paying ~4% per annum for 12 months (if the bank passes it on), but the inflation rate is higher, so in real terms, your term deposit investment is going backwards ... for now. But this is good place for parking and for defensive investors.

The US two-year treasury bond rate is higher at 4.17% than the 10-year bond rate of 3.59% - this inversion or spread is apparent and so something in the US needs to give.

Some asset sectors like fixed-interest, and equities have adjusted in value considerably having commenced on June 15, 2022. Liquid assets such as shares are valued daily using the interest rate as a discount rate applied on the sum of future expected cash-flows. We see these price movements more clearly and are felt sooner.

Illiquid assets like unlisted property and private debt however have not adjusted. APRA and ASIC finally expect Super Funds to look at their valuations and disclosure of assets, urging them to be more proactive. ASIC Commissioner Danielle Press said in the AFR today "the unlisted assets base is really critical to get right, and we need to make sure that in volatile markets, things have been looked at".

Currently, CBUS Super has 12% in unlisted property. Australian Super (Balanced) has around 30% in unlisted assets. QSuper (Balanced) has recently reclassified their alternatives into property, these assets have been reallocated into equities all in the space of nine months. Recent Morningstar Research has highlighted that these Super Funds can be known for poor disclosure. As such, you need to weigh-up which Super Fund is suitable to your goals and risk tolerance.

So where do you go and what do you do? Well it depends on your plan and everyone's is different.

- debt should be review regularly.

- your asset allocation should be review annually

- if in a superannuation drawdown phase, please check your cash levels are appropriate

- Defensive equity positions are a sound strategy (like health, utilities, staples, and telecommunications whose cash-flows are reliable) and so is having a long-term view to ride out the volatility, buying quality in the dips and/or holding.

- Fixed interest and income yields are attractive

A value style is working well now, growth is not unfortunately but cycles change. We always prefer quality as a core approach. Active management of successful outcomes are mixed but so too is passive management or index funds, where Apple and Microsoft dominate now holding 13% of the S&P500 index (and information technology represents 27%).

Overall the global markets outlook is favourable in the medium and long-term. There are some bumps to follow.

As always, if you wish to discuss any of these risks further generally or wish to be advised personally, both Ian and I are here to assist you.

For More Information

For assistance or more information, please contact James Cavanough at Lantern Advisory on (07) 3002 2690 or via jamesc@lanternadvisory.com.au.