There have been a couple of rounds of economic stimulus announced by the Government, to help us cope with the economic and social displacement caused by the Coronavirus. These measures are designed to assist people suffering hardship and include early access of superannuation, temporary reduction of superannuation minimum drawdown rates, and a reduction in social security deeming rates.

There are of course a range of business measures for owners and employees alike, such as cash flow assistance, JobKeeper payments and more, in addition to possible loan repayment relief.

Please note the stimulus is appropriate for helping with unemployment, redundancy, reduced income/revenues, cash flows and capital preservation for individuals and business. It is not designed to prop up asset prices. Information regarding eligibility can be found here.

Businesses struggling with cash flows, characterised with high fixed costs and leverage, please take action and seek advice. We can assist you, so please contact us for more information.

Early access to superannuation

With the advent of COVID-19, the Government announced an additional temporary condition of release that will enable eligible people to access up to $10,000 of superannuation benefits in the 2019/20 financial year, and a similar amount in the 2020/21 financial year.

As with a lot of financial decisions, there are pros and cons associated with this. You can access your own money now, but it will have long term ramifications. Before you consider accessing superannuation benefits, it is important to know two things:

- Accessing superannuation benefits early will reduce the amount that is available for retirement. Taking out money now means losing the benefit of compound interest over a number of years. Depending on how old you are, withdrawing from your superannuation now could see you miss out on more than double that amount by the time you retire.

- Accessing superannuation early, which results in an account being closed, or reduces an account balance to less than $6,000, may result in the loss of valuable insurance cover.

If you intend to apply for access to funds in the 2019/20 financial year, an application must be made to the Australian Taxation Office between 20 April 2020 and 30 June 2020.

If intending to seek funds in 2020/21, an application will need to be made between 1 July 2020 and 24 September 2020. Applications cannot be made after 24 September 2020.

Only one application can be made in each of the financial years. If an application is made to access (for example) $6,000 in 2019/20, a second application cannot be made to access the remaining $4,000 in that same year. However, an application may still be made to access up to $10,000 in 2020/21.

Any amounts accessed under this condition of release will be paid free of tax and they will not be assessed as income for the purposes of assessing entitlement to social security benefits such as the JobSeeker Payment.

To be eligible for the early release of funds a person must:

- Be unemployed, or

- Be eligible to receive a JobSeeker Payment, Youth Allowance JobSeeker, Parenting Payment, Special Benefit or Farm Household Allowance, or since 1 January 2020:

- They were made redundant, or

- Their working hours were reduced by 20% or more, or

- If a sole trader, their business was suspended or suffered a reduction in turnover of 20% or more.

A reduction in working hours of 20% or more is relative to working hours or turnover for the September and December 2019 quarters.

An application for release of benefits is to be made to the Australian Taxation Office via the myGov website: www.my.gov.au.

Alternatively, and primarily for people unable to access online services, a request can be made by contacting the Australian Taxation Office on 13 10 20.

The Australian Taxation Office will authorise the applicant’s superannuation fund to pay the amount released directly to the applicant.

Before lodging a request for the early release of superannuation benefits, consider seeking advice from a financial adviser. They may be able to suggest alternatives to help address short-term financial difficulties rather than having to withdraw money from your superannuation.

Temporary reduction in superannuation pension drawdown requirements

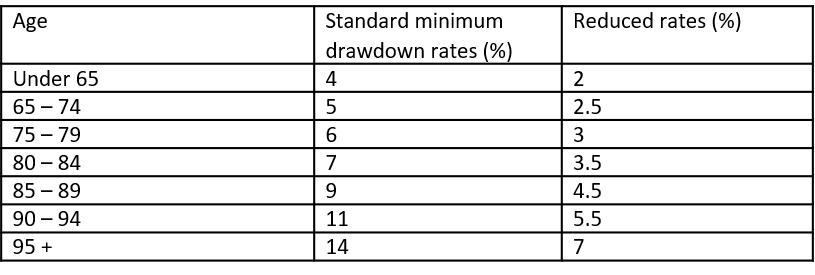

Similar to the course of action taken in the GFC of 2008/09, the minimum drawdown requirements for account-based pensions and similar income streams will be temporarily reduced by 50% for the 2019/20 and 2020/21 years. The revised rates will be as follows:

At first glance this appears counterintuitive, where other measures are about putting cash in people’s pockets. This policy rationale is a result of one very obvious consequence that investment markets have fallen considerably, and volatility continues. Many pension recipients will be concerned about selling assets to fund pension payments within their superannuation fund, when cash is not available to make these payments. This will allow relief of pressure to sell assets.

Also, this measure will help pension recipients who have already taken their minimum and wish to retain their superannuation within the superannuation fund that is tax efficient by stopping their payments for 2019/20 and restarting at the reduced rate in 2020/21. This will benefit the capital duration of the superannuation fund over the medium and long term.

Changes to social security deeming

In further changes, the Government approved new lower deeming rates for Centrelink/DVA income tested benefits. The measure is a further 0.25% drop to the lower rate to 0.25%, and 0.25% to 2.25% in the higher rate. This means more income paid from Centrelink where you are an existing recipient and especially where you already receive a partial benefit due to exceeding either the minimum assets and/or income test thresholds.

If you would like a review of your situation or know someone that might benefit from an advice relationship, please contact us.

The information contained in this article is of a general nature and does not take into account personal circumstances. Before making any decisions based on the factual information contained in this document please consult with your financial adviser.