Retirement planning is an investment advisers so called “bread and butter”, with resources, research and technology available to help manage a client’s retirement journey. Retirement advice and an acceptable drawdown rate has become a more topical discussion point where more Australian retire without advice, and in a shrinking pool of advisers locally. Unexpected events have wreaked havoc on individuals and families, such as flood, covid and an inflationary event in Europe all affecting asset values, performance, income and diverging risks sped up by ever-changing technology and the looming need for better security.

According to the Australian Bureau of Statistics (ABS, 2020), 16% of Australia’s population are retirees or 4.2 million (as at 30/6/20) whose average retirement age is 55, equal to superannuation preservation age that is increasing depending on your date of birth, to age 60. In terms of longevity, females live to 85 on average and 81 for males. So, this means your retirement savings may need to last from 20 to 30 years time.

On average 50% of retirees depend on the age pension and 25% depend on superannuation for retirement income. APRA the superannuation regulator produces similar data that suggests an increasingly unfunded retirement pattern over time. On my calculation using ABS averages, there are around of 500 Australians retiring each day. Q Super say it’s higher at 700 per day.

According to Australian Super Funds of Australian, couples of around 65 now need $69,691 per year to achieve a comfortable retirement and $49,462 for singles, after retiree budgets rose another 2.5% in 2023.

4% Rule of Thumb

The ‘4% Withdrawal’ strategy is a common retirement planning methodology which advises that retirees can safely withdraw 4 percent of their investment portfolio savings during the first year of retirement, and then the same $ amount adjusted to inflation in each subsequent year for up to 30 years.

The formula assumes a standard investment portfolio of 60% shares/equities and 40% bonds, whilst also maintaining the same current level of spending throughout retirement years.

The concept was first established in the early-to-mid 1990s amid a period of financial insecurity and intended to act as a “conservative” approach to retirement expenditure, ensuring an investors savings stretched longer.

Whilst established in a different economic climate, the concept continues to be utilised in today’s investment world, remaining a sound approach to money-management in retirement.

However, given today’s economic outlook and inflationary and cost of living increases, it may be questioned whether the ‘4 percent’ rule still applies or if retirees do something different to stretch their savings further given longevity is also increasing.

What the latest Data is Saying?

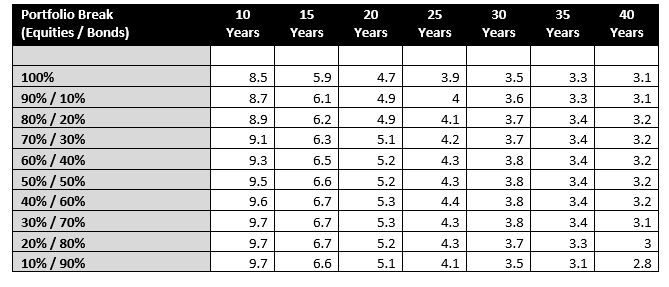

Recent 2023 Morningstar Australia research indicates that a more appropriate withdrawal rate may sit somewhere between 3.3% - 3.8%, in keeping with a “conservative approach” close to the defined 4 percent rule. However, we note these withdrawal rates are not considered a ‘steadfast’ approach and may differ based on individual circumstances – such as investor risk tolerance, the asset allocation of a portfolio which is the primary driver of returns, and “unexpected” lump sum requirements during periods of volatility.

The data highlights the biggest consideration towards keeping a safe withdrawal rate in-line with portfolio performance.

As such, in today’s economic environment, retirees who are willing to employ more flexible drawing strategies may benefit from a higher starting withdrawal %, however the trade-off against greater fluctuations is fewer leftover assets at the end of an assumed 30-year retirement period, and a potentially the degree of dependence on the Centrelink age pension benefit that is well below ASFA living standards.

For those retirees aiming to leave larger financial legacies to family or charity, the above formula may be a more prudent tactic – especially where the individual’s portfolio resembles the assumed 60/40 breakdown.

It is worth noting, in recent years due to certain events, some retiree portfolio values have declined – therefore a higher starting withdrawal percentage may not translate to an increased but rather decreased spending ability in retirement. Similarly, the data acknowledges that retirees don’t often spend in-line with inflation increases, with typical retirement expenditure increasing by roughly 1% per year.

As you may well know, Retirees often spend the most money in the early years of retirement, then gradually reduce spending over their retirement years. Spending might elevate again in the later years of retirement to fund higher healthcare outlays, especially long-term care. As such, disciplined withdrawal rates aligned to your retirement wishes and needs and expected performance rate is best for a long-term approach.

For retirees with an alternative time horizon (such as 10 to 15 years), portfolios with equity weightings of less than 40% generally supported higher withdrawal rates than more aggressively positioned portfolios would.

This is highlighted in the table below (refer to the 10 and 15 year columns):

The table also shows, where you may have 70% in equities (or growth risk assets) and 30% in bonds (or other defensives like cash and term deposits), and your draw down rate is 9.1% per annum of the portfolio value, your retirement capital will deplete in around 10 years time. Similarly, on the same portfolio structure, if your draw down at 5.1% per annum, your investment savings will last another 10 years, up to 20 years. Quite a difference.

A guide such as this is merely a guide, and ultimately the retiree’s choice with how they want to live, but we know that unexpected events seem to occur more often than not these days and some prudence can be helpful, such as a cash and fixed interest or capital stable portfolio buffer.

In conclusion, alternative strategies will have trade-offs with regards to real cash flow in retirement, with results ranging from modest to more dramatic against the standard 4% rule. Therefore, it’s important to look at an ideal future drawdown rate or engage with a financial adviser to discuss which approach best reflects your wishes and financial situation/ability over time, and even stress test those outcomes.