This blog provides an update on the SMSF sector, and given its considerable size and representation, it is worth providing some factual information. There has been some mis-information distributed by the media of late so we have sought to clarify where things stand today.

A Self-Managed Superannuation (SMSF) is a private super fund that you manage yourself or outsource to specialists. This trust like structure with available tax concessions is usually established by an individual, family member or business owner as a means of looking after one’s superannuation savings. This hands-on approach has continued to be popular in recent years among a broad range of investors and demographics.

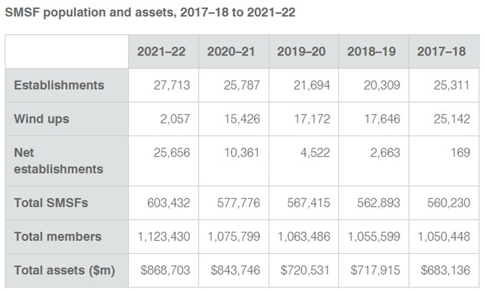

SMSFs are becoming increasingly popular – with the number of funds increasing from 576,810 in 2021 to 603,449 in December 2022 (source ATO). This equates to a growth rate of 4.6%. These funds hold an estimated $868,703 billion in assets as at 30 June 2022, as the following table shows:

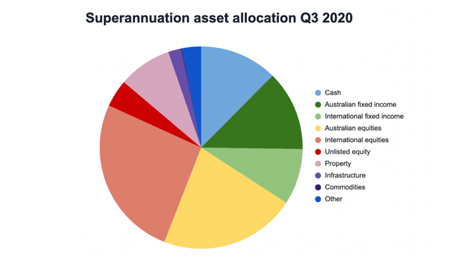

With the total superannuation sector holding roughly $3.3 trillion in assets, SMSFs hold just under 25% of the total market share. In assessing the underlying fund exposures , SMSFs have diversified portfolio allocations, with private investors preferring Australian Shares (28%), Cash (16%), and Commercial Property (10%) as their investments of choice (source: Association of Superannuation Funds of Australia [ASFA]).

SMSFs differ to other funds with lower asset allocation exposure to alternative assets, but contain more Direct or Real Property and Cash.

Pros & Cons of SMSF

As a significant financial commitment and obligation, deciding whether a SMSF is appropriate to you is a first essential step , and engaging with a qualified professional to discuss your plans is valuable. We’ve highlighted some of the pros and cons of SMSFs below:

Pros of a Self-Managed Superannuation Fund

- Greater Control

In your capacity as trustee, you are in charge and responsible for the activities and planning of the SMSF. You can decide the investment selection, investment management, insurances that might be attached and who benefits from it. For example, you can nominate who should receive member death benefits, given this structure is not an estate asset, who benefits and how.

- Greater Investment Strategy

As an SMSF trustee, you have the freedom to choose from a wide variety of investments, including “direct investments” such as Real Property, Shares, and alternatives that may offer less volatility.

Likewise, you can pursue a mix of asset allocation that best reflects your risk tolerance and retirement planning strategy which may be difficult to implement within a standard superannuation fund.

- Flexible Management

Within an SMSF, trustees have greater flexibility surrounding the transition from accumulation to pension phase, with options available to maximise superannuation benefits to boost retirement income.

The structure within an SMSF allows more tailored decision-making at pre & post-retirement, with the ability move back-&-forth between accumulation and pension phases where your circumstances may change and a return back to work required. With this, members are able to run a mixture of accumulation and pension accounts.

- Tax Effective Earnings

Depending on your situation, one significant benefit of a SMSF is the flexibility trustees have over the tax position of the fund. In the lead-up to retirement, maximising your savings through various tax strategies available and in pension phase with SMSFs offering benefits to their members only.

Creating tax efficiencies through salary sacrifice, withdraw and re-contribution, spouse splitting and contributions are all available, varying to your circumstances that may change over time. Additionally, as trustees move towards retirement phase, there are a number of financial planning strategies which can be used to help reduce tax.

Cons of a Self-Managed Superannuation Fund

- Greater Administration Requirements & Costs

In managing your own SMSF, you are required to take greater action in the administration of the fund, with initial outlay costs possibly being an expensive endeavour. Additionally, on-going financial management fees can be costly, with SMSFs requiring greater adherence to compliance and audit requirements.

- Greater Duties & Responsibilities as Trustee

When you establish an SMSF, you as the individual take on all responsibility (risk) for investment decisions and management. With this, greater regulatory compliance is required to be understood, with trustees needing to submit all relevant information for financials and audit , and maintain their obligations.

- Not Set & Forget

Running an SMSF can be time-consuming. This is especially true where the need to continually review investment decisions, e.g. research to identify and manage investments that are appropriate to your circumstances, in line with Financial Investment Strategy Minutes.

In deciding which strategy is appropriate to you, it is best to speak with a qualified professional who can provide detailed insights into which strategy is best suited to you and who can assist in forming and reviewing a plan that meets your long-term requirements.

For More Information

For assistance or more information, please contact James Cavanough at Lantern Advisory on (07) 3002 2690 or via jamesc@lanternadvisory.com.au.