The global and domestic economic reopening remains on track as COVID-19 vaccination rates climb and containment processes improve. While rising inflation has become a concern, the spike in prices looks transitory so far. Ultimately, we still like the pandemic recovery trade that favours equities over bonds, value over growth, and non-U.S. stocks over U.S. stocks.

Key Market Themes

With mid-June vaccination rates close to 50% in the United States and Europe, over 60% in the United Kingdom and beginning to finally accelerate in Japan, we believe the economic reopening should continue across the major developed economies through the second half of 2021, as expected. Amid this backdrop, the focus for markets has shifted to the strength of the growth rebound, the implications for inflation and the timing of central-bank moves to taper asset purchases and eventually raise interest rates.

Our view is that the inflation spike is mostly transitory, a combination of base effects - from when the U.S. consumer price index fell during the initial lockdown last year - and temporary supply bottlenecks. We believe that market expectations for the U.S. Federal Reserve (the Fed) to begin hiking rates in 2022 are premature, with 2023 more likely.

Our cyclical, value and sentiment investment decision-making process leads us to conclude that global equities remain expensive, with the very expensive U.S. market offsetting better value elsewhere. We see sentiment as close to overbought, but not near concerning levels of euphoria. The business cycle is still in the early recovery stages following the lockdown-induced recession, with the strong cycle giving us a preference for equities over bonds for at least the next 12months - despite expensive valuations. Sustainable and growing earnings are key to ensuring current lofty valuations remain firm. This view also reinforces our preference for value over growth and for non-U.S. equities to outperform the U.S. market, but always fundamental quality.

In the U.S., S&P 500 earnings growth shattered industry consensus expectations in the first- quarter (52% actual vs. 24% expected), and we expect the results for the second quarter to be considerably stronger as the reopening progresses. Strong earnings delivery will be particularly important for the U.S. market, given current valuations based on a range of risk measures.

In Europe, the vaccine rollout has gathered pace and a more sustained reopening of economies is on track for the second half of the year, although we note infection rates remain high. Valuations however reflect this and we believe the MSCI EMU Index, which reflects the European Economic and Monetary Union, to outperform the S&P 500 in 2021. The region’s exposure to financials and cyclically sensitive sectors such as industrials, materials and energy – as well as its relatively small exposure to technology - gives it the potential to outperform in the post-vaccine phase of the recovery, when economic activity picks up and yield curves in Europe steepen.

We believe the UK is set for a strong rebound in both gross domestic product (GDP) and corporate profits as it recovers from the dual headwinds of Brexit and the pandemic. The UK market is also overweight the cyclical value sectors, such as materials and financials, that are benefiting from the post-pandemic reopening. We believe that financials should be boosted by improving interest margins as the Bank of England moves closer to lifting interest rates (although we don’t expect it to move before the Fed). The UK, as reflected by the FTSE 100 Index, is the cheapest of the major developed equity markets, and we think this should help it deliver higher returns than other markets over the longer term.

Chinese equities have struggled over the last couple of months, in part due to increasing regulation on Chinese technology companies - and in particular, their foray into financial services. Forecasting regulation measures is a difficult task, but our base assumption is that most of the regulation changes are behind us for now. Regarding Japan, we expect a solid economic recovery through the back half of the year, boosted by strong global capital-expenditure spending and a return to services activity domestically.

The Australian economy continues to exhibit solid growth, and at mid-year has more people employed than before the COVID-19 outbreak. We expect that the Reserve Bank of Australia will continue its quantitative easing programme until the Fed begins to taper, and that a rise in the cash rate is still some way away. Labour market data is particularly strong and productivity fundamentals improving. COVID-19 infection rates have been well contained to date, politics aside! It might be worth considering fixing your variable mortgage rates too, the interest rate cycle will inevitably change.

A new line of thinking

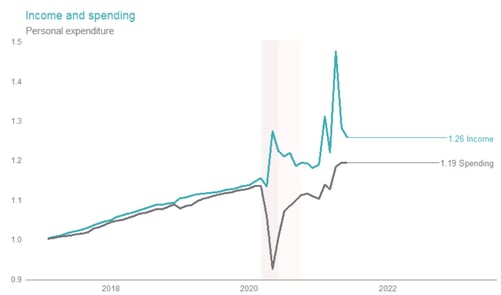

At the economic level, data provided via Bloomberg and Aequitas, determines recent global trends of income and spending over the relevant period. In the chart below, the resilience of income supporting spending back to pre-COVID levels is arguably proof that recessions, with all of the loss in employment, income and wealth that they entail, may not need to occur. This line of thinking is very popular with the left, with modern monetary theorists like Stephanie Kelton, and increasingly with centrists.

For markets, the idea here is that Central Banks will always look to support markets in the event of a material drawdown in risky assets. Eliminating the negative feedback loop between the economy and the stock market would arguably support higher multiples for the market in perpetuity, via a lower required equity risk premium, and by the reverse effect of likely higher productivity and growth (certainty).

Given the involvement of central banks and government in the economy and markets since the GFC of 2007/08 and more recently and in combination with the expected ongoing strength in labour markets, and the economy more broadly, there remains a strong case for continuing to deploy capital especially while cash rates remain at historical low levels. The interest rate and QE cycle will turn however and will be interesting to see how central banks and government role in managing the adjustments to asset valuations, economy and confidence.

Asset Class Views

Equities: Preference for non-U.S. equities

The post-vaccine economic recovery should favour undervalued cyclical stocks over expensive technology and growth stocks. Relative to the U.S., the rest of the world is generally more undervalued and offers greater cyclical upside.

Fixed income: Government bonds expensive

Our long held view is that Government bonds are expensive, and think that yields will be under upward pressure as capacity gaps close and central banks look to taper back asset purchases. Given fixed interest can be a large part of a traditional Balanced portfolio, active asset allocation and managers are sought. We prefer allocations to Credit, short duration and floating rate notes.

Currencies: U.S. dollar likely to weaken

The U.S. dollar should weaken once investors have fully priced in Fed tightening expectations and as the global economic recovery becomes more entrenched. The dollar typically gains during global downturns and declines in the recovery phase. The main beneficiary is likely to be the Euro, which is still undervalued. We also believe the Pound Sterling and economically sensitive commodity currencies like the AUD can make further gains, although these currencies are no longer undervalued.

Soft Metals / Commodities

There is a place for certain commodities like gold to be used in portfolios as a diversifier and hedging instrument if your view is towards a steep inflationary lift and in the presence of greater economic uncertainty.

If you require further information please contact us at info@lanternadvisory.com.au or on (07) 3002 2690.

Sources: Russell Investments, Aequitas, Bloomberg and the author

Please note these are general views and should not be considered personal advice whereupon consideration must be given to your circumstances, needs, objectives and risk tolerance.