The unfortunate facts about cancer

In Australia, cancer is the second most common form of death and accounts for about three in 10 deaths. In the under 40 age group, cancer is the largest cause of natural disease deaths in younger Australians.Cancer is a disease with significant social, emotional and economic toll.

- In 2018, it is estimated that 138,321 new cases of cancer will be diagnosed in Australia (74,644 males and 63,676 females)

- In 2018, it is estimated there will be 48,586 deaths (27,552 males and 21,034 females) from cancer

- In 2017, the risk of an individual dying from cancer by their 85th birthday will be 1 in 5

[Source: Cancer.org.au, CancerAustralia.gov.au].

The Cost of Cancer

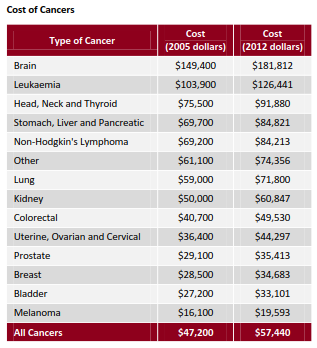

The average cost of the 14 commonly identified cancers is $63,418 for medical costs alone. Prostate cancer is estimated to cost $39,098 on average, and breast cancer $38,151, in today’s dollars. Lung, kidney, stomach and liver, leukemia and thyroid are all more expensive than these.

For additional budget care, that is, costs for travel, medical progress and further treatment are between $64,000 and over $400,000 depending on the level of care required.

Rice Warner actuaries estimated the cost of cancer in 2012, some time ago, so the costs below the table are adjusted for inflation:

Having a contingency plan

As much as we would all rather think about something else, how would you cover your medical and living costs if you were diagnosed with cancer?

Critical Illness or Trauma is the type of insurance that covers cancer. Upon diagnosis, a successful claim will pay the life insured a lump sum, designed to cover all associated medical costs. Premium payments are generally not tax deductible unless for key persons in a business. But you can have Critical Illness attached to income protection insurance.

Critical Illness cover gets expensive later on in life, so we suggest to take it out when a person is younger and on a level premium. The policy can be held long term, costs are generally fixed and known. Everyone I speak to who has claimed successfully on a Critical Illness policy will stress to those they love and protect to get some. I don’t hear from those who wish that they had and didn’t get cover because sometimes you don’t get a choice, so this involves consideration and choice.

The cost for a 30 year old female for $100,000 of Trauma cover, who has an administrative occupation, is ~$30 per month on a level premium, so it can be kept into her 50s and 60s.

More information

Please contact me if I can provide you with more information on tailoring an insurance plan for you and your family that considers Critical Illness or Trauma Insurance. My number is 07 3002 2690 or email jamesc@lanternadvisory.