Personal risk insurance explained

Personal risk insurance protects your wealth accumulation strategy by providing money if you are no longer able to earn an income due to disability, trauma or death. The money received can help with medical bills, loan repayments and living expenses.

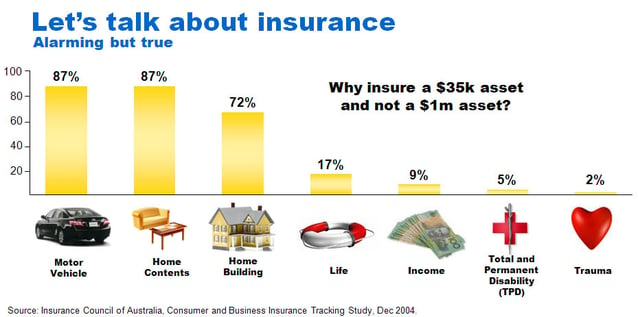

Often people underestimate the importance of personal insurance which has led to a problem with underinsurance in Australia. It is important that you have enough cover to replace your income to cover your current and unavoidable living expenses.

“Don’t let personal tragedy create financial tragedy.”

You can apply for insurance to cover you in the event of death, temporary or permanent disability, or trauma (critical illness). Outlined overleaf is a brief outline of the different types of personal risk insurance.

Life insurance

The most common type of cover is life insurance. Life insurance will pay a lump sum to your estate or specific beneficiaries in the event of death, or in some cases, terminal illness.

The advantage of life insurance is peace of mind that your death will minimise any financial hardship for your loved ones. Life insurance can be used to pay off debts, provide an income for dependents, cover funeral expenses and generally assist in maintaining your family’s lifestyle in the event of your death.

With this type of cover, your family would not be burdened by debt and may be protected from selling assets to pay debts or cover living expenses.

Total and permanent disability insurance

Total and permanent disablement (TPD) can prevent you from working and require expensive medical treatment and ongoing care.

TPD insurance aims to provide a lump sum if you suffer an illness or injury and you:

- Are permanently unable to work again, or

- Are unable to care for yourself independently, or

- Suffer significant and permanent cognitive impairment

TPD insurance pays a lump sum which can be used to pay for medical expenses, ongoing care costs and to meet living expenses for you and your family.

The definition of TPD can vary and may include options for a range of occupations including homemakers. Options that you can choose from include:

- Any Occupation TPD: the benefit will be paid if you are unlikely to be engaged in any gainful business, profession or occupation to which you are reasonably suited by your education, training or experience. This definition is generally less expensive than an Own Occupation definition but for some people may be harder to meet

- Own Occupation TPD: the benefit will be paid if you are unlikely to ever be engaged in your own occupation. Own Occupation TPD provides a generous definition as it is specific to your occupation and is particularly suitable for specialist occupations. The premiums for this type of definition are more expensive than Any Occupation TPD

You should speak with one of our financial planners to confirm which option best suits your situation.

Trauma insurance

A serious illness or injury can prevent you from working for a period of time and may require expensive medical treatment.

Trauma insurance (also known as critical illness, crisis or recovery insurance) aims to provide a lump sum upon the diagnosis of a specified illness or injury such as life threatening cancer, stroke or heart attack. Trauma insurance pays a lump sum which can be used to pay medical expenses and reduce any financial pressure while you focus on recovery. This payment is made regardless of whether you are able to return to work and is designed to relieve financial pressure at a time when you are under great stress.

Child trauma insurance can be added to your policy to cover a seriously ill or injured child. This provides a lump sum to help you cover medical treatment and eases financial worry for parents who may need to take time off work to provide care.

Income protection insurance

Income protection insurance aims to minimise the financial impact of sickness or injury by replacing income lost during a prolonged absence from work. A monthly benefit will assist you to meet living expenses and debt repayments.

Income protection policies will usually pay a benefit up to 75 per cent of your gross income (some policies may pay higher) after a waiting period. Payments continue for a set term or until you return to work. Generally premiums for income protection are fully tax deductible.

- Waiting period: this is the time period that you must be off work before an income benefit is payable. Waiting periods range from 14 days to two years. Generally, the longer the waiting period, the lower the cost of the income protection insurance

- Benefit period: starting at the end of the waiting period, the benefit period is the maximum time the benefit is paid. Options range from two years, five years or until a specified age such as age 65

Types of contracts include:

- Agreed value: the monthly benefit is agreed at the time of application and will not reduce even if your income decreases after your policy commences. This option provides certainty and peace of mind on how much income you will receive. If details of your income are provided at the time of application, the benefit can be guaranteed so that no further financial assessment is required at the time of claim

- Indemnity value: the monthly benefit paid depends on your earnings at the time of a claim rather than at the time of application. If your income at the time of claim is lower than it was when the policy started, the monthly benefit may be reduced accordingly. Details and proof of income will be required at the time of claim

You can generally claim a tax deduction for the premiums paid on an income protection policy to reduce the effective cost but any income payments received are considered taxable income.

Quick quiz

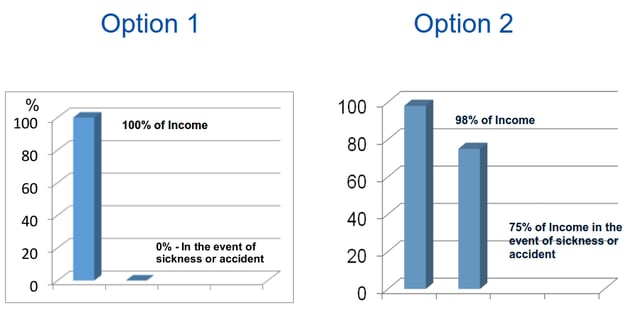

Income protection – which one would you choose?

Option 2?

Even though two per cent of your annual gross income may go towards maintaining an income protection policy (the cost is tax deductible), it is better to receive 75% of your gross income than none at all to keep up with daily bills, cost of living, family living standard, loan repayments and medical costs etc in the event of sickness or injury.

Want more information on how your can protect your assets with the right type of insurance to suit you, your family and your business?

Instantly download the FREE Lantern Advisory Ebook "Strategic Insurance to Protect Your Wealth" by clicking the image below. We provide you with information on best practices and pitalls to avoid as not all insurance policies are created equally.

You are also welcome to contact Ian Walker or James Cavanough from Lantern Advisory on 07 3002 2690 for a free and confidential discussion regarding your personal situation.

Our promise to you - your contact details will remain confidential at all times. You will receive approximately one email per month with valuable information to improve your financial situation, however you can subscribe from this correspondence at any time.

PS. Sign up to receive the Lantern Advisory Blog - regular financial planning tips and updates.